Egypt Tackles Economy Challenges through IMF-Guided Monetary Policy and Limited Overdrafts

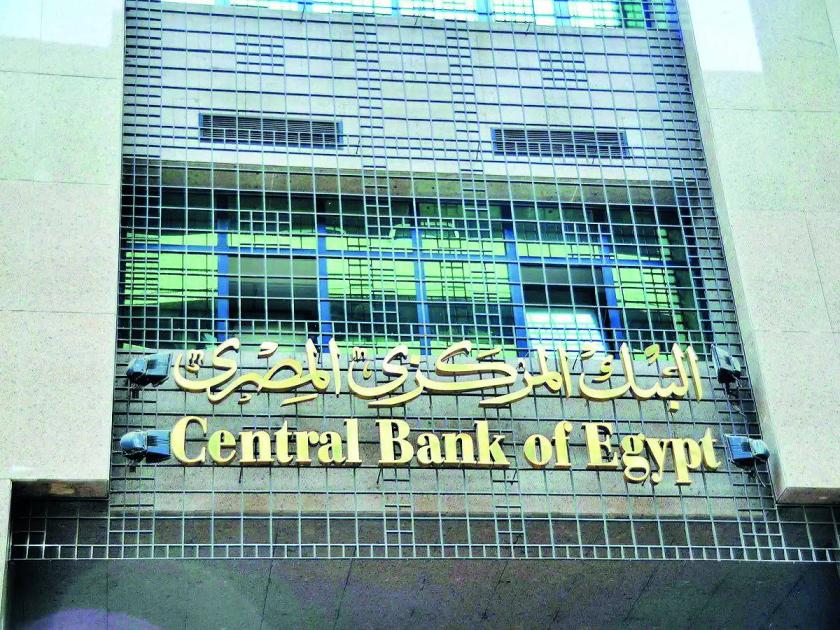

Egypt has made significant strides to address its reliance on overdraft facilities from the central bank and off-budget public sector activities, as outlined in a recent report by the International Monetary Fund (IMF). The report came just four weeks after the IMF approved an $8 billion financial support program for Egypt.

One of the key areas of focus in the report was Egypt’s commitment to addressing weaknesses such as the central bank’s lending to public bodies. The Fund highlighted that Egypt has taken steps to tighten monetary policy, implement a flexible exchange rate system, and raise gasoline and fuel prices since December 2022. However, it also noted that a return to a fixed exchange rate in February 2023 had negative consequences for the economy.

The report underscored several issues facing Egypt’s economy, including a shortage of foreign exchange, high inflation, and restricted imports due to the fixed exchange rate. It also pointed out that delayed interest rate increases and excessive investment in national projects had contributed to inflation and exchange rate problems. Furthermore, the central bank’s lending practices were scrutinized, with significant lending to government bodies outside of the Ministry of Finance leading to inflationary pressures.

The Egyptian government has been working hard to limit government overdrafts and prevent further lending from the central bank to government bodies. This commitment is evident in efforts made by Egypt’s central bank, which has lent substantial amounts of money outside of the Ministry of Finance, leading to inflationary pressures. Nevertheless, these actions have shown positive signs in stabilizing Egypt’s economy and ensuring sustainable growth.

The IMF board meeting in March 2024 highlighted both challenges and opportunities facing Egypt’s economy. The crisis in Gaza was noted as having had an impact on Egypt’s economic stability. However, progress was also made when it comes to investment deals like that between Egypt and UAE. Despite these challenges, there remains hope for positive changes for Egypt’s economy moving forward.

In conclusion, this report highlights how Egypt is actively addressing various aspects of its economic challenges through measures such as monetary policy adjustments and limiting government overdrafts from central banks while improving lending practices and investment decisions aimed at promoting sustainable growth in its economy.